Features and Functionality

When evaluating FreshBooks, its robust features and functionality make it a standout choice for small businesses and freelancers seeking reliable accounting software. The platform provides a comprehensive suite of tools designed to streamline financial management and enhance business operations.

One of its notable features is the intuitive invoicing system. Users can create and send professional invoices using customizable templates, automate recurring billing, and accept payments online. This functionality simplifies the billing process, ensuring timely payments and reducing administrative overhead.

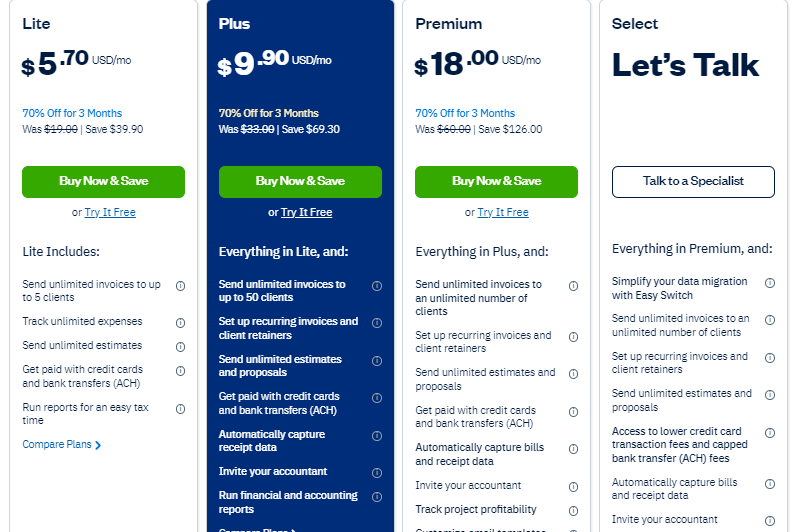

Expense tracking is another area where the software excels. It allows users to easily categorize and track expenses by linking bank accounts or uploading receipts directly through the mobile app, helping to maintain accurate financial records and simplify tax preparation.

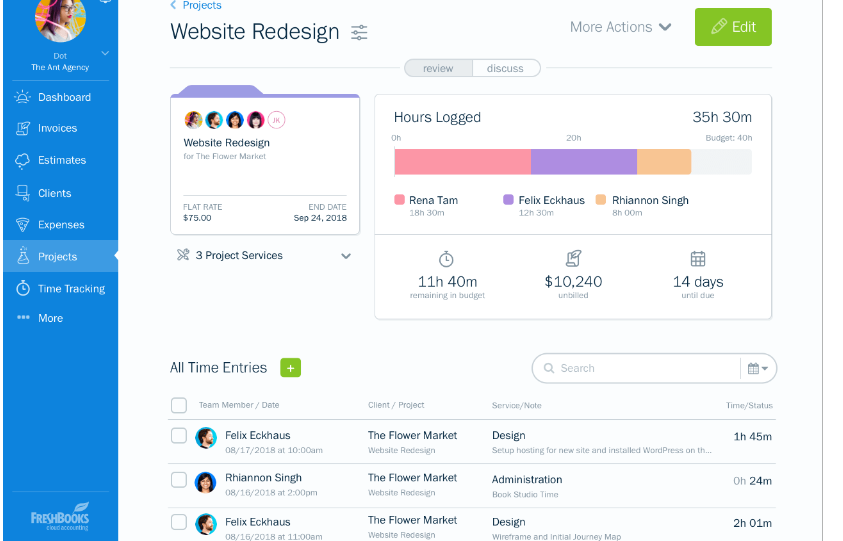

The time tracking tools are particularly useful for freelancers and service-based businesses. They can log billable hours and generate detailed time reports, ensuring accurate invoicing and efficient time management.

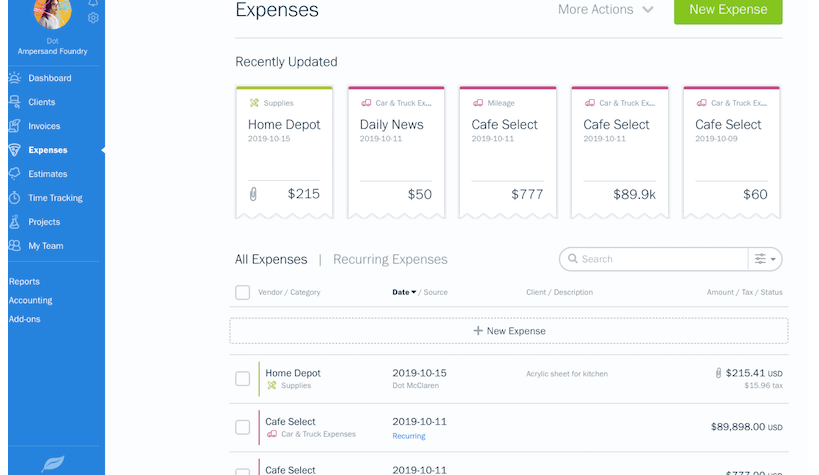

In addition to these core features, FreshBooks offers financial reporting tools that provide insights into business performance. Users can generate reports on profit and loss, expenses, and revenue, aiding in informed financial decisions and tracking business growth.

Customer support is another strength, with accessible and responsive service available via email, phone, or live chat, ensuring prompt resolution of issues and questions.

The platform also integrates with various third-party applications, enhancing its functionality. Whether connecting with payment gateways, CRM systems, or project management tools, it supports diverse business needs.

Customization options allow users to tailor invoices, reports, and other documents to fit their brand’s identity, ensuring professional and consistent client communications.

Adding images such as screenshots of the invoicing interface or expense tracking features could provide visual context and make this section more engaging for readers.

Pricing Plans

| Plan | Lite | Plus | Premium |

|---|---|---|---|

| Price | $15/month | $25/month | $50/month |

| Users | 1 | 1 + additional users | Multiple users |

| Invoicing | Unlimited invoices | Unlimited invoices | Unlimited invoices |

| Expense Tracking | Yes | Yes | Yes |

| Time Tracking | Yes | Yes | Yes |

| Proposals | No | Yes | Yes |

| Advanced Reporting | No | Yes | Yes |

| Dedicated Account Support | No | No | Yes |

| Customizable Features | No | Limited | Extensive |

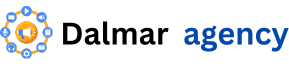

When evaluating FreshBooks for your accounting needs, understanding its pricing plans is crucial. FreshBooks offers several pricing tiers to accommodate various business sizes and needs, making it easier to find a plan that suits your requirements.

FreshBooks Pricing Plans Overview

FreshBooks provides three primary pricing plans: Lite, Plus, and Premium. Each plan is designed to offer a range of features that cater to different business needs.

Lite Plan

The Lite plan is ideal for freelancers and solo entrepreneurs. It includes essential features such as unlimited invoicing, expense tracking, and time tracking. This plan is perfect if you need basic accounting functionalities without the complexity of additional features.

Plus Plan

The Plus plan is suited for small businesses with a growing client base. It includes everything in the Lite plan, plus additional features like proposals and the ability to manage more than one user. This plan also offers advanced reporting options, which can be beneficial as your business expands.

Premium Plan

For larger businesses or those with more complex needs, the Premium plan offers comprehensive features including all the benefits of the Plus plan, along with dedicated account support and more customization options. This plan supports a higher number of users and provides advanced reporting and financial insights.

Which Plan is Right for You?

Choosing the right FreshBooks plan depends on the size of your business and the complexity of your accounting needs. If you’re just starting out or working as a freelancer, the Lite plan may be sufficient. As your business grows and you require more advanced features, the Plus or Premium plans can offer additional support and functionality.

Ease of Use

FreshBooks is renowned for its intuitive and user-friendly interface, making it a top choice for small business owners and freelancers seeking straightforward accounting solutions. The platform is designed to simplify financial management, allowing users to easily navigate through various features without a steep learning curve. The dashboard provides a clear overview of essential tasks such as invoicing, expense tracking, and financial reports, all accessible from a single, organized location.

One of the standout aspects of FreshBooks’ ease of use is its streamlined invoicing system. Users can create and send professional invoices in just a few clicks, thanks to customizable templates and automated features. Adding images here, such as screenshots of the invoice creation process or the dashboard, can visually demonstrate how user-friendly and efficient the process is.

Additionally, FreshBooks offers a range of helpful resources, including tutorials and customer support, to assist users in getting the most out of the platform. Whether you are new to accounting software or a seasoned professional, FreshBooks ensures that you can efficiently manage your finances without getting bogged down by complex processes. Including images of the support resources or tutorial sections could further illustrate the accessibility and support available to users.

Invoicing and Billing

When it comes to invoicing and billing, FreshBooks stands out with its user-friendly and efficient features. The platform allows users to create professional-looking invoices quickly and easily. With FreshBooks, you can customize invoices to include your company logo, choose from various templates, and even set up recurring billing for regular clients. The ability to automate invoice generation and send reminders reduces the time spent on administrative tasks and helps ensure timely payments.

One of the key benefits of FreshBooks’ invoicing system is its integration with online payment gateways. This feature enables clients to pay invoices directly through the invoice itself, significantly speeding up the payment process. FreshBooks supports various payment methods, including credit cards and PayPal, making it convenient for clients to settle their bills. Additionally, the platform provides detailed insights into invoice statuses, allowing you to track which invoices have been paid and which are still outstanding.

For a more comprehensive view, consider adding a screenshot of the FreshBooks invoicing interface to illustrate the customization options and ease of use. Another useful image could be a sample invoice showing different payment methods available. These visuals will help readers better understand the features and functionality of FreshBooks’ invoicing and billing system.

Time Tracking

When evaluating FreshBooks, user reviews and feedback reveal a wealth of insights into its performance and reliability. Many users appreciate its intuitive interface and robust invoicing features, which streamline the process of managing client payments and tracking expenses. Positive reviews often highlight FreshBooks’ customer support, noting the responsiveness and helpfulness of the support team in resolving issues and answering questions. Additionally, users frequently commend the platform’s ability to integrate seamlessly with other tools, enhancing its functionality and making it a versatile choice for managing business finances.

However, some users have pointed out areas for improvement. A few reviews mention that while FreshBooks is excellent for basic accounting tasks, it may lack advanced features required by larger businesses or more complex financial needs. Additionally, a small number of users have reported issues with the mobile app, noting occasional glitches and limited functionality compared to the desktop version. Adding images such as screenshots of user reviews or ratings could enhance this section, providing visual context to the feedback and making the content more engaging for readers.

Expense Tracking

FreshBooks excels in expense tracking, making it a standout choice for small businesses and freelancers looking to streamline their financial management. With its intuitive interface, FreshBooks allows users to effortlessly categorize and track their expenses, helping them stay organized and maintain accurate records. Users can upload receipts directly through the mobile app, which are then automatically matched to expenses, reducing the chance of errors and saving time. This feature is particularly useful for those managing multiple projects or clients, as it provides a clear and detailed view of where money is being spent.

To enhance your understanding of FreshBooks’ expense tracking capabilities, consider including screenshots of the expense tracking dashboard and the receipt uploading process. These images will help illustrate how users interact with the tool and highlight its ease of use. Additionally, a comparison chart showing how FreshBooks’ expense tracking stacks up against competitors can provide valuable context for readers.

Financial Reporting

FreshBooks excels in financial reporting, offering a range of tools that simplify the tracking and analysis of your business finances. This feature is a significant strength, allowing users to generate comprehensive reports such as income statements, expense reports, and profit and loss summaries. These reports are designed to be straightforward, providing clear insights into your financial performance without overwhelming complexity. The ability to quickly access and interpret these reports helps small business owners and freelancers make informed decisions and manage their finances effectively.

To enhance your understanding of FreshBooks’ financial reporting capabilities, consider adding images of sample financial reports generated by the platform. Screenshots of income statements or expense summaries can illustrate the user-friendly interface and highlight key features. This visual aid will help readers better grasp how FreshBooks presents financial data and how it can benefit their business.

Security and Data Protection

When it comes to choosing an accounting software, security and data protection are paramount. FreshBooks takes these concerns seriously, offering robust security measures to ensure your financial data remains safe. The platform employs advanced encryption protocols to protect sensitive information during transmission and storage. FreshBooks is compliant with industry standards such as GDPR and CCPA, which means it adheres to strict regulations regarding data protection and user privacy.

For users, this means that your invoices, financial records, and personal details are safeguarded against unauthorized access and potential breaches. FreshBooks also offers two-factor authentication, adding an extra layer of security to your account. Consider adding a screenshot of the FreshBooks security settings page to visually demonstrate the security features, and an infographic showing how FreshBooks’ encryption compares to industry standards could further illustrate its commitment to data protection.

User Reviews and Feedback

When evaluating FreshBooks, user reviews and feedback offer valuable insights into its real-world performance. Many users praise FreshBooks for its intuitive interface and ease of use, highlighting how the platform simplifies invoicing and expense tracking. Freelancers and small business owners often commend FreshBooks for its reliable customer support and the comprehensive range of features that cater to their accounting needs. Positive reviews frequently mention the platform’s seamless integration with other tools and its ability to streamline financial management tasks efficiently.

However, some users have noted areas for improvement. A few have pointed out that the pricing can be on the higher side compared to other accounting solutions, especially for users who require advanced features. Additionally, while FreshBooks is robust in many aspects, there are occasional mentions of limitations in its reporting capabilities. Balancing these pros and cons helps prospective users make an informed decision about whether FreshBooks meets their specific needs.

Comparison with Competitors

When evaluating FreshBooks, it’s crucial to compare it with other popular accounting tools to gauge its strengths and limitations. FreshBooks excels in providing an intuitive interface and robust invoicing features, making it particularly suited for freelancers and small businesses. Its pricing plans offer competitive value, but it may lack some of the advanced features found in competitors like QuickBooks. QuickBooks, for instance, provides more extensive financial reporting and integration options that might be preferable for larger businesses.

To give a clearer picture, here’s a comparative table of FreshBooks and its main competitors:

| Feature/Tool | FreshBooks | QuickBooks | Xero |

|---|---|---|---|

| Ease of Use | User-friendly | Slightly complex | User-friendly |

| Invoicing | Robust | Advanced | Robust |

| Pricing | Competitive | Higher tiers | Competitive |

| Expense Tracking | Basic | Advanced | Advanced |

| Financial Reporting | Limited | Extensive | Extensive |

| Integrations | Moderate | Extensive | Moderate |

| Mobile App | Strong | Strong | Strong |

Adding images of FreshBooks’ dashboard and key features alongside similar screenshots from QuickBooks or Xero will help illustrate these differences effectively. This comparison table and visual aids can assist users in choosing the tool that best fits their needs based on specific functionalities and pricing structures.

Overall Value for Small Businesses and Freelancers

When evaluating the overall value of FreshBooks for small businesses and freelancers, it’s essential to consider how its features align with their specific needs. FreshBooks offers a range of functionalities designed to simplify financial management, from intuitive invoicing to comprehensive expense tracking. The platform’s ease of use and robust reporting tools make it a practical choice for those who need to manage their finances efficiently without a steep learning curve. Its pricing plans are scalable, catering to different business sizes and requirements, which adds to its value proposition for users seeking a cost-effective solution.

For small business owners and freelancers, the value of FreshBooks extends beyond just its core features. The platform’s strong customer support and integration capabilities enhance its functionality, making it a versatile tool that can adapt to various business processes. Adding images of FreshBooks’ dashboard and key features can help illustrate these benefits visually, providing potential users with a clear understanding of what to expect. Additionally, screenshots showing pricing plans and user feedback can offer further insights into its overall value, aiding in the decision-making process.

(FAQs)

What is FreshBooks?

FreshBooks is a cloud-based accounting software designed for small businesses and freelancers. It provides tools for invoicing, expense tracking, time tracking, and financial reporting.

How much does FreshBooks cost?

FreshBooks offers several pricing plans, each with different features and capabilities. Plans are typically billed monthly or annually, with discounts available for longer-term commitments. Pricing tiers range from basic plans suitable for freelancers to more advanced options for small businesses.

Is FreshBooks easy to use?

Yes, FreshBooks is known for its user-friendly interface and ease of use. It is designed to simplify accounting tasks, making it accessible even for users without a background in accounting.

Can FreshBooks handle multiple currencies?

Yes, FreshBooks supports multiple currencies, allowing users to manage invoices and expenses in different currencies and handle international transactions seamlessly.

Does FreshBooks integrate with other apps?

FreshBooks integrates with a variety of third-party applications, including payment processors, CRM systems, and project management tools. This helps users streamline their workflows and enhance the functionality of the platform.

Is there a mobile app for FreshBooks?

Yes, FreshBooks offers a mobile app that allows users to manage their accounting tasks on the go. The app includes features such as invoicing, expense tracking, and time logging.

How secure is FreshBooks?

it uses encryption and secure servers to protect user data. Regular backups and robust security measures ensure that your financial information is safe and secure.

Can FreshBooks handle payroll?

it does not offer built-in payroll features. However, it can integrate with third-party payroll services to manage employee payments and payroll-related tasks.

How does FreshBooks compare to QuickBooks?

is often noted for its simplicity and user-friendly interface, making it a popular choice for freelancers and small businesses. QuickBooks offers more advanced features and is suitable for users with more complex accounting needs.

Does FreshBooks offer customer support?

Yes, it provides a range of customer support options, including email support, live chat, and a comprehensive knowledge base. Users can access resources and get help with any issues they encounter.

Conclusion

In summary, FreshBooks offers a robust set of features that cater to the needs of small businesses and freelancers. Its intuitive interface simplifies invoicing, expense tracking, and time management, while its integration with payment gateways enhances efficiency. With solid customer support and strong security measures, it provides a comprehensive solution for financial management. Whether you’re looking to streamline your accounting processes or need a reliable tool for managing your business finances, FreshBooks stands out as a valuable option. Explore its features to see how it can support your financial goals and improve your workflow.